The adoption of the ASC 606 standard has significantly impacted the way businesses recognize revenue. NetSuite, as a comprehensive ERP solution, offers robust features to assist organizations in complying with ASC 606 and ensuring accurate financial reporting. This blog explores how NetSuite can streamline the revenue recognition process, enhance visibility, and mitigate risks.

Understanding ASC 606

ASC 606, also known as the Revenue from Contracts with Customers standard, outlines the criteria for recognizing revenue in financial statements. Key components of ASC 606 include:

-

Contract Identification: Identifying contracts that qualify for revenue recognition.

-

Performance Obligations: Determining the specific performance obligations within a contract.

-

Transaction Price: Measuring the consideration to be received from a contract.

-

Transfer of Control: Recognizing revenue when control of goods or services is transferred to the customer.

-

Contract Costs: Allocating contract costs to revenue recognition.

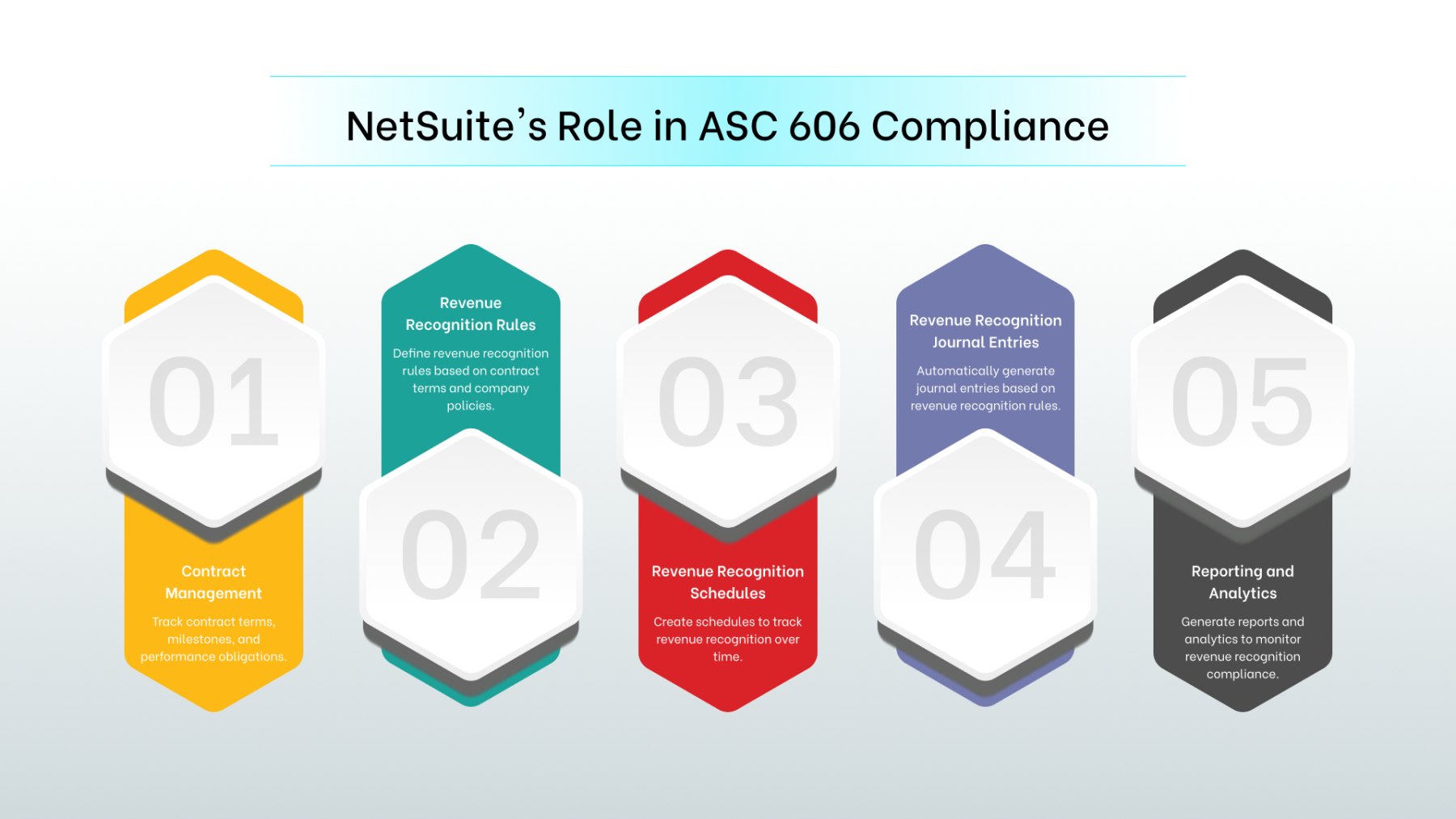

NetSuite's Role in ASC 606 Compliance

NetSuite provides a comprehensive suite of tools and features to assist organizations in complying with ASC 606:

-

Contract Management: Track contract terms, milestones, and performance obligations.

-

Revenue Recognition Rules: Define revenue recognition rules based on contract terms and company policies.

-

Revenue Recognition Schedules: Create schedules to track revenue recognition over time.

-

Revenue Recognition Journal Entries: Automatically generate journal entries based on revenue recognition rules.

-

Reporting and Analytics: Generate reports and analytics to monitor revenue recognition compliance.

Benefits of Using NetSuite for ASC 606 Compliance

-

Improved Accuracy: Ensure accurate revenue recognition in accordance with ASC 606.

-

Enhanced Visibility: Gain better visibility into revenue recognition processes and metrics.

-

Reduced Risk: Mitigate the risk of financial misstatements and regulatory penalties.

-

Streamlined Processes: Automate revenue recognition tasks and streamline workflows.

-

Improved Decision Making: Make data-driven decisions based on accurate revenue recognition data.

Key Considerations for ASC 606 Compliance

-

Contract Evaluation: Carefully evaluate contracts to identify performance obligations and determine the transaction price.

-

Data Accuracy: Ensure accurate and complete data to support revenue recognition calculations.

-

Documentation: Maintain proper documentation to support revenue recognition decisions.

-

Internal Controls: Implement strong internal controls to prevent errors and fraud.

-

Ongoing Monitoring: Continuously monitor revenue recognition processes and make adjustments as needed.

Advanced Features and Functionality

NetSuite offers advanced features to support ASC 606 compliance, including:

-

Multiple Revenue Recognition Methods: Support various revenue recognition methods, such as percentage of completion and installment.

-

Revenue Recognition Schedules: Create complex revenue recognition schedules based on contract terms.

-

Revenue Recognition Journal Entries: Automatically generate journal entries based on defined rules.

-

Integration with Other Systems: Integrate with other systems, such as CRM and ERP, for a comprehensive view of revenue recognition.

Industry-Specific Considerations

The specific requirements for ASC 606 compliance may vary depending on industry and business model. Industries such as software, manufacturing, and services have unique considerations.

Conclusion

NetSuite provides a powerful platform for organizations to comply with ASC 606 and ensure accurate revenue recognition. By leveraging NetSuite's features and best practices, businesses can streamline their financial processes, reduce risk, and improve overall compliance.

How Techwize Can Help

Techwize, with its expertise in NetSuite and financial accounting, offers comprehensive services to assist organizations in achieving ASC 606 compliance:

-

NetSuite Implementation: Our experts can help you implement and configure NetSuite to meet your specific revenue recognition requirements.

-

ASC 606 Consulting: We can provide guidance on interpreting ASC 606 and applying it to your business.

-

Process Optimization: Our team can help you optimize your revenue recognition processes for efficiency and accuracy.

-

Data Migration and Integration: We can assist in migrating your existing data into NetSuite and integrating it with other systems.

-

Training and Support: Our experts can provide training and ongoing support to ensure successful adoption and utilization of NetSuite for ASC 606 compliance.

By partnering with Techwize, you can accelerate your implementation of NetSuite for ASC 606 compliance, reduce risk, and improve your financial reporting.